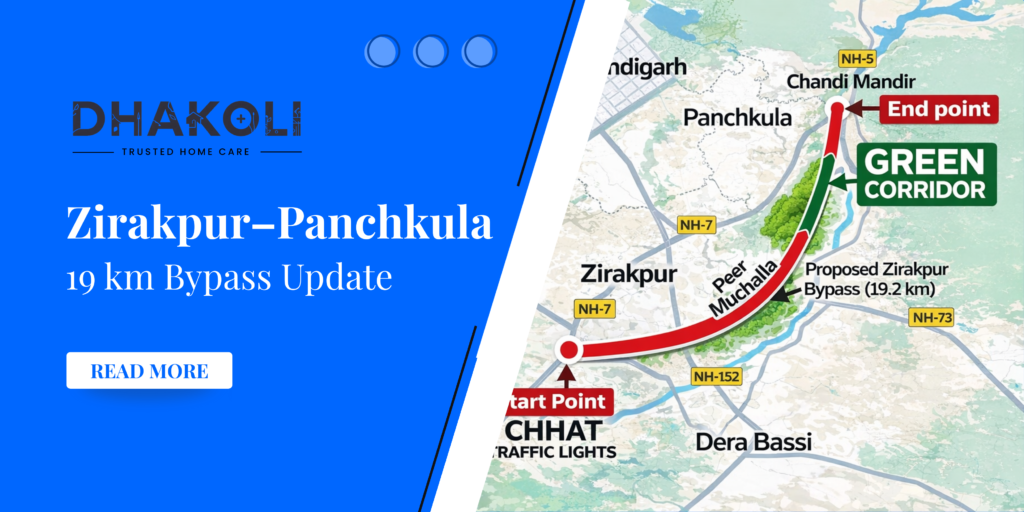

A proposed 19–19.2 km, six-lane bypass linking the NH corridors around the Dhakoli area promises major traffic relief and large infrastructure investment. This article explains the project details, timeline, current status, realistic price impacts for Sector 26–28 (Panchkula), contractor possibilities, local rumours, and how you should plan content and listings for dhakoli.com.

Quick project snapshot

The government approved a ~Rs 1,878.31 crore six-lane bypass of roughly 19–19.2 km that will connect key junctions near Zirakpur and Panchkula. The scheme includes an elevated section (≈6.2 km), multiple flyovers, underpasses and bridges designed to divert through-traffic around congested urban stretches.

The bypass is intended to reduce congestion along the NH corridors serving Chandigarh, Zirakpur and Panchkula and improve direct connectivity toward Himachal Pradesh and northern routes.

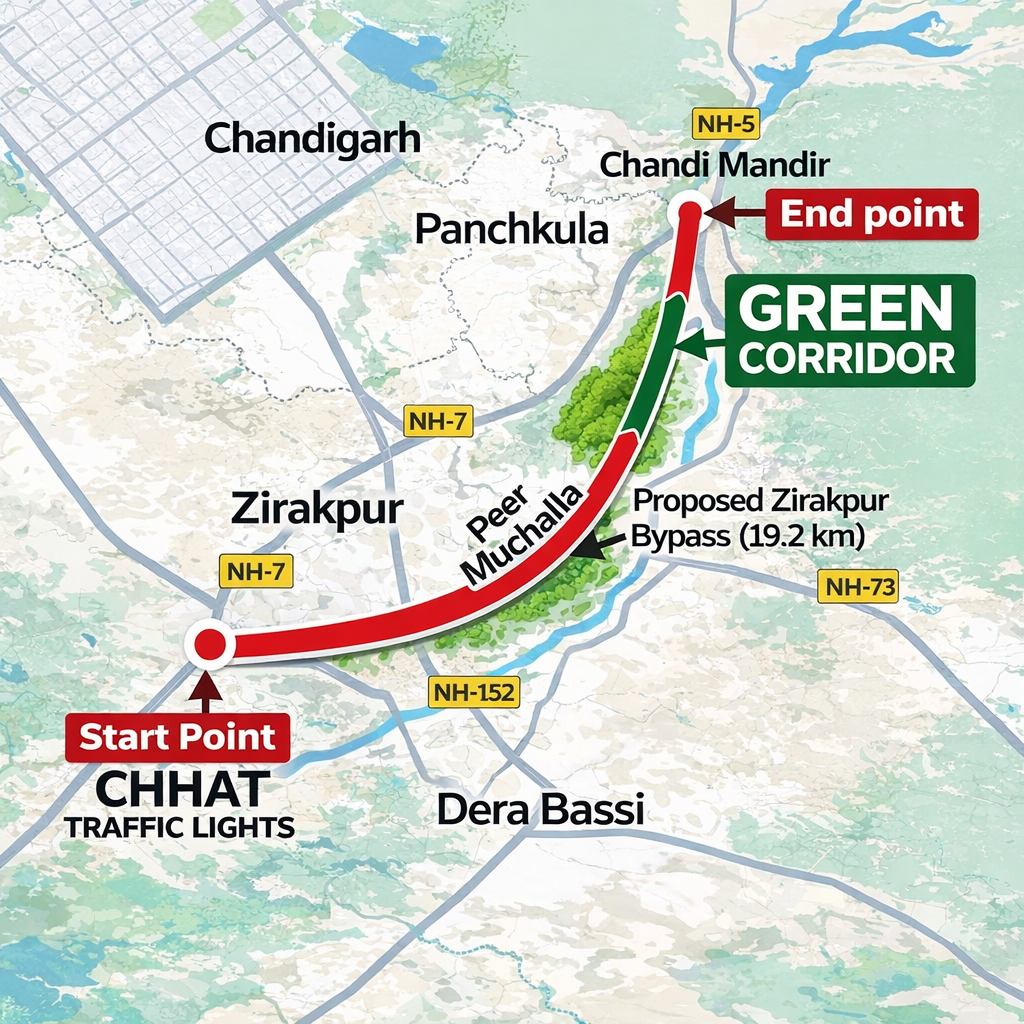

Where it runs (route & map)

The route starts near the NH-7 junction close to the Zirakpur side and terminates near NH-5 at Panchkula — deliberately skirting the most built-up sections to save travel time for long-distance traffic. The official DPR and tender documents give precise chainages and alignment; interactive maps from recent reports show the bypass crossing/overpassing several local roads near Dhakoli and the Sector 20–26 Panchkula fringe.

Timeline — announced, tender, current status

- Announcement / approval: The project was publicly approved and reported in April 2025 as part of central infrastructure planning.

- Tender activity: NHAI floated (and had updates on) a tender in mid-2025 for the construction package (reported June 2025), and there were subsequent timeline updates and extensions. Recent reporting in major local papers says the project is now “nearing reality” with administrative clearances and tender updates continuing into early 2026.

- What’s next: Once the tender is awarded, statutory clearances, land acquisition and utility shifting typically take several months before full mobilisation. Official tender award notices will confirm the contractor and start dates.

Technical highlights (what will actually be built)

- Length: ~19.0–19.2 km total; includes an elevated section of about 6.195 km in the busiest stretches.

- Lanes: Six lanes in major stretches with grade-separated interchanges, flyovers and required bridges/rail overbridge works.

- Features: Multiple light vehicle underpasses, major and minor bridges, drainage and service roads to reduce local displacement effects.

Who can build it (likely contractors)

Large national civil-infra contractors with highway experience are typically shortlisted or bid for such packages. Examples of firms that appear on many major NHAI highway contracts are: Larsen & Toubro (L&T), IRCON International, NCC Limited and JMC Projects (JMC). Any of these, or large EPC consortiums and local heavy civil contractors, could bid depending on the tender conditions and financials. (The final list will appear in the tender award notice.)

Tip for your site: monitor the NHAI tender portal and local state PWD announcements and post a “Tender Watch” update on dhakoli.com when the bid is awarded.

Land-price data & realistic forecasts (Sector 26, 27, 28 — Panchkula)

Below are market snapshots from active listings and local property portals (figures are illustrative ranges from recent listings; always verify with local registries / brokers before transacting):

- Sector 26 (Panchkula): recent plot listings show asking prices commonly in the ballpark of ₹17,000–₹20,500 / sq.ft for prime plots (large variance by plot size and frontage).

- Sector 27 / 28: sample listings and developer offers for large plots show figures that can range widely; some premium listings reported prices in the ₹9–15 crore bracket for larger commercial/residential plots — per-sqft rates often follow Sector 26 trends but can be slightly lower in outer sectors.

- Dhakoli / Zirakpur fringe: Dhakoli remains comparatively lower in absolute Rs/sq.ft than fully developed Panchkula sectors, making it attractive for speculators and homebuyers; portals show residential plot asking prices and developer project rates that highlight this gap.

Realistic impact expectation: When a major bypass is approved and construction starts, nearby land typically sees interest (more enquiries, some speculative buying), and prices for well-located plots can appreciate — often in the low-double digits percentage range (10–30% over 12–24 months) depending on scale, connectivity and local liquidity. However this is NOT guaranteed: actual uplift depends on final alignment, exact proximity, obstruction/compensation issues, statutory clearances and whether the road creates direct access to a plot or instead bypasses it without new access ramps. Use caution when extrapolating short-term gains; immediate jumps often reflect speculation rather than realized value.

Rumours & what people are saying

Local rumour themes you’ll see on neighbourhood chats, WhatsApp groups, and broker forums:

- “Sector 26–28 prices will skyrocket.” — Common, but usually speculative until tender award + acquisition finishes.

- “Government will buy land at high compensation” — Compensation rates are governed by acquisition laws; some owners may be offered market or market+ solatium, but disputes are frequent.

- “Builders will snap up land before rates climb” — Happens, but depends on liquidity and risk appetite of developers.

- “Tender already awarded to big contractor” — Often hearsay; should be confirmed with official NHAI award notifications.

How to present rumours responsibly on your blog: label them clearly as unverified community reports, give dates, and link to official sources (tender pages, government press releases) for facts. Use a “Rumour vs Reality” box to separate sentiment from verifiable facts — that builds credibility.

When will it be “confirmed” and when will tenders be awarded?

- Confirmed (officially): A public approval (cabinet / ministry / NHAI sanction) plus published Project Sanction Order (PSO) and DPR marks formal confirmation — this already happened during 2025 reporting.

- Tender award: The tender float and subsequent evaluation lead to a contract award notice (NHAI’s official tender portal will show the L1 bidder and contract value). Until you see the contract award document, statements that “work will begin next month” are premature. Recent coverage indicates tender activity and extensions through 2025 — watch for the award notification.

Local impacts (traffic, commute, environment, utilities)

- Traffic: Long-distance through traffic (trucks and inter-state vehicles) will be diverted, reducing congestion on local stretches and improving safety.

- Commute times: Commuters traveling across districts will likely save 20–40% of through-travel time once the bypass is operational — but local feeder roads may experience short-term disruption during construction.

- Environment & utilities: Construction brings dust, utility shifting and ecological clearances; expect phased clearances and mitigation measures. Compensation and rehabilitation for affected landowners are common issues — present both benefits and concerns in your blog.

Sources & further reading

- NHAI / project reports and tender notices (project sanction reporting).

- Local press coverage: The Tribune — “Zirakpur–Panchkula bypass nears reality” (recent update).

- Real-estate portals with live listings and price ranges (99acres, Housing.com, RealEstateIndia, MagicBricks).

- Local news reporting on land fraud cases — cautionary context.